kansas sales tax exemption form pdf

Tax Exemption Application Page 5 of 5 TAX EXEMPTION INSTRUCTIONS 1. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms.

79-201b Hospitals Group.

. The entire Form ST-28H including the direct purchase portion must be. Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Kansas sales tax you need the appropriate Kansas sales tax exemption certificate before you can begin making tax-free purchases.

Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services. See also Resale Exemption Certificate Requirements in Publication KS-1520 Kansas Exemption. Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason.

The seller may require a copy of the buyers Kansas sales tax registration certificate as a condition for honoring this certificate. 79-201 Ninth Humanitarian service provider TX Addition 79-201 Ninth pdf KSA. Printable Kansas Exemption Certificates.

We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. And provide their Kansas sales tax number on this form may use this certificate to purchase inventory without tax. 79-3606k WHEN ALL THREE 3 OF THE FOLLOWING ARE MET.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from. Certificate Form ST-28 and present it to the Kansas supplier in order for the Kansas salescompensating tax exemption to apply.

Notice 21-26 Sales Tax Exemption for Certain Motor Vehicles Sold. You can find resale certificates for other states here. Manufacturing - Partial Exemptions.

The purchaser is a bona fide resident of a state other than Kansas 2. The motor vehicle semitrailer pole trailer or aircraft will be removed from Kansas within 10 days of purchase and. Sales or Use Tax.

Tax Exempt entities located outside of Kansas who do regular business in Kansas are encouraged to apply for a department issued Tax. Kansas Sales Tax Exemption Resale Forms 4 PDFs. Or Generic Exemption Certificate Form ST-28 and present it to.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. TX Application Form pdf Additions to Property Tax Exemption Application. Please type or print this form and send a completed copy WITH worksheets to your utility company.

You may also obtain the. _____ Business Name. Is exempt from Kansas sales and compensating use tax for the following reason.

Is exempt from Kansas sales and compensating use tax for the following reason. Bwsales tax exemptions 22615. Street RR or P.

Ad CA BOE-501-DG S1F More Fillable Forms Register and Subscribe Now. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. REQUIRED TO PAY KANSAS SALES TAX UNDER THE NONRESIDENT EXEMPTION PROVIDED FOR BY KSA.

The Leading Online Publisher of National and State-specific Legal Documents. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. KS-1528 Application for Sales Tax Exemption Certificates.

This page explains how to make tax-free purchases in Kansas and lists four. Box City State Zip 4. For other Kansas sales tax exemption certificates go here.

Address of meter location. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Keep these notices with this booklet for future reference.

The statement of facts must be in affidavit form. Of Revenue issues. Each application for tax exemption must be filled out completely with all accompanying facts and attachments.

Streamlined Sales Tax Certificate of Exemption. KANSAS DEPARTMENT OF REVENUE. STATEMENT FOR SALES TAX EXEMPTION ON ELECTRICITY GAS OR WATER FURNISHED THROUGHONE METER.

Vehicles Sold to Nonresidents for Removal from Kansas Revision of Form ST-8B OCTOBER 25 2021 The Kansas. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. If any of these links are broken or you cant find the form you need please let us know.

If the out-of-state retailer DOES NOT have sales tax nexus with Kansas it may provide the third party vendor a resale exemption certificate evidencing qualification for a resale e xemption regardless. Street RR or P. T00112020 The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not.

Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. Complete a form for each meter o which you are applying for an exemption. _____ Business Name.

If you are applying for a property tax exemption pursuant to the following statutes you must attach a completed Addition to your TX application form. Street RR or P. Please reference the KANSAS Business Taxes for Schools and Educational Institutions a 34-page publication provided by the Kansas Department of Revenue.

Manufacturing - Full Exemptions. Applications or statements that have not been signed by the property owner before a Notary Public will not be considered. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms.

You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page. Check the appropriate box for the type of exemption to be claimed. All items selected in this section are exempt from state and local sales and use.

Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction Exemption Certificate for the sale to be exempt. Box City State Zip 4.

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale C Letter Templates Certificate Templates Certificate Of Achievement Template

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

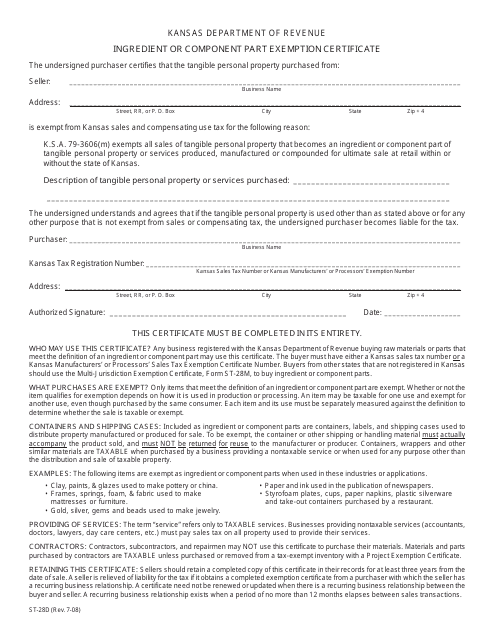

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

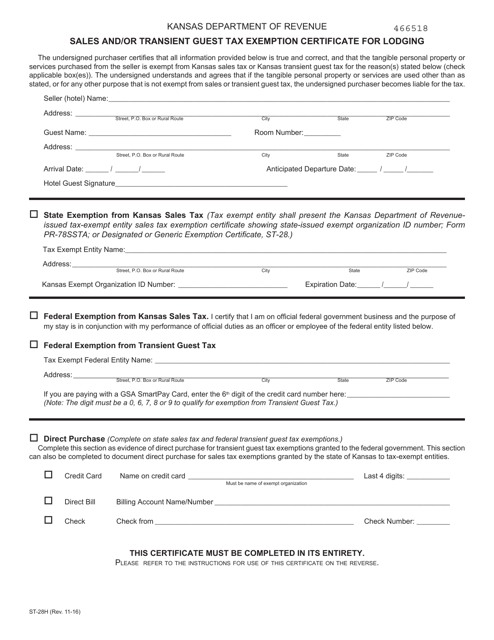

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller